Monthly Archives: October 2015

Stocks Open Lower As Market Eyes Data

U.S. stocks opened down today, as investors prepare for earnings while worrying about Chinese data.

“The market today is going to be focused on earnings,” said Peter Cardillo, chief market economist at Rockwell Global Capital.

Over a 1/5 of the S&P500 companies are scheduled release results this week. Morgan Stanley posted earnings per share 20 cents below estimates before the bell, with revenue also disappointing.

Hasbro and Halliburton reported quarterly results ahead of Monday’s open that beat analyst’s expectations.

Housing data will offer more clues about the strength of the U.S. economy, with the latest NAHB/Wells Fargo Housing Market index due at 10 a.m. ET.

Wall Street will also digest remarks made by Federal Reserve officials Lael Brainard and Richmond Fed President Jeffrey Lacker at 10 a.m. ET and noon, respectively.

Free Penny Stock Picks Can Cost You Thousands

The fact is, they are not researchers, they don’t care if the company is even real.

The dirty secret they don’t want you to know?

They Are Paid To Pick That Stock!

The truth is one of two things (and you can verify this every time):

1) Someone paid them to promote the stock, so they could SELL when telling you to buy!

2) The website owns shares and are selling, profiting off the rise in price! You are buying THEIR shares!

Facts:

-They are not producing real research, they are paid to “pump” the stock.

-They are paid in either cash or in shares of stock, or both.

-While telling you to buy now, they are selling everything they can and cashing in.

-If paid in cash, a large shareholder (possibly an executive) is selling and cashing out.

-Their “Disclaimer” (usually hidden) will reveal how much they were paid.

Why does this happen?

Simply put, many penny stocks do not trade much volume. Because of that, any increase in buying will push the price higher and allow sellers to cash out – at higher prices. It is worth it for the CEO or other large shareholder to pay a website $10,000 to pump their stock if it means they can sell hundreds of thousands of shares at much higher prices!

We see it time and time again. As long as the promoting website or newsletter discloses they are being paid, it’s technically legal. But they are skilled at hiding that and relying on the fact that most people will believe them without checking.

The newest scam has these same penny pumpers telling you they are watching the same promoters and you can profit off of the move when a promotion starts. They pretend to be traders, with a free site or penny stock newsletter, of course. They’re there to help you make money off of those darn pumpers! The fact is, they are the penny pick pumpers. It’s just another lie to get you to believe they’re working for you. Of course they are, your money!

A great example of a “pump and dump” scam is one we told our readers about in December and January. North Springs Resources (NSRS) was a classic.

At the time the campaign started, NSRS had reported a total of $16 (That’s just 16, as in $16.00) in cash on hand and property worth $59,990. $60,589 was reported in total assets. And yet, the stock had a market capitalization of $300 million.

Just before the start of the penny stock pump, the President, Harry Lappa filed for numerous stock splits so that he now owned a total of 500 million shares of NSRS.

The company then filed an 8-K stating they were working on a deal to acquire mineral rights to a property purported to have gold deposits. The only claim made at all was that the property was part of the “prestigious Mineral Ridge Mining District, Esmeralda County, Nevada”. That means nothing. It could be a parking lot and still be part of that district.

The company hired Carrillo Huettel, LLP as corporate counsel. The same firm that was ordered by a Federal judge to hand over its bank records as it was being accused of stock fraud. Good company, no?

AwesomePennyStocks.com was paid to promote the penny stock and did so through its affiliates effectively – as usual, by PRETENDING to look like they do penny stock pick research, and HIDING the fact they were being paid. Hundreds of emails and notices sent out to investors over and over. Of course, they never mentioned any of the news about the President, or the Corporate Counsel, none of that, just how exciting the land acquisition was! Of course, the company never intended to actually buy the land, just issue press releases that it “intended” to. If you believe that they really intended to, I have some lovely Florida swampland – no, make that “lake-front property” to sell you.

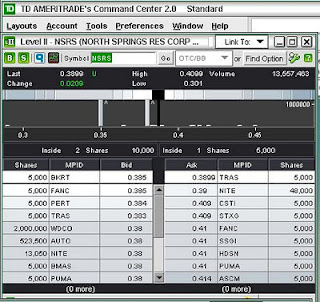

Now, the biggest scam of all that day was this: Fake bids being placed to buy shares of stock. Take a look at the Level II screen showing the massive bids of over 2.5 million shares showing. Those are there to keep the sellers thinking it might be going higher so they stay back while the President sells all he can. Those huge bids always stay below other bids so they are never actually buying shares. It’s all a show, a scam.

Those are there to keep the sellers thinking it might be going higher so they stay back while the President sells all he can. Those huge bids always stay below other bids so they are never actually buying shares. It’s all a show, a scam.

After more than a decade working on trading floors, I can tell you one fact: Market-Makers WOULD NEVER show 2,000,000 shares to buy even if they had an order. Never! Showing your large order would cause the price to rise, making you and your client have to pay higher prices. That is NEVER done. What we have here is fake bids being placed hoping to push the stock higher. Why? Because they are actually selling.

Here is a chart of the penny stock pick pump scheme. As you can see, when the emails and touting ended, the stock fell off the cliff. Guess who still owned shares when that happened? Guess who had already sold all of theirs?

There are very few penny stock pick websites our these like ours that are not paid to promote. We provide pure, honest research in small companies. If you decide to join a penny stock newsletter or penny stock website, please read their disclaimer first! Find out if the are paid or can be paid, and find out if they own or can own shares of the stock. If so, STAY AWAY! Many say they are not paid – but they own shares – that is the SAME as being paid!

Our only financial interest is in keeping our subscribers happy so they come back again and again. Doing it the honest way, our way, means making much less money. But we can sleep at night.

– See more at: http://falconstocks.com/freepennystockpicks.html#sthash.lgXLMd70.dpuf

Insider Trading: What It Really Means When The CEO Sells

For almost a decade, we worked in the “Private Corporate Client” area of an international brokerage firm. “Private Corporate Client” is just another way of saying “Insider” as a majority of our clients were insiders selling their restricted shares and companies themselves doing buybacks/repurhcases. Because of that experience, we know why insiders REALLY SELL or BUY their company’s shares. The actual reasons will probably surprise you.

We’re not talking about illegal insider trading; that is, when someone with insider (non-public) information trades a stock based on that information. We’re talking about when an officer, director, or other executive buys or sell shares.

We were the guys that would help these executives jump through the hoops they needed to so that they would be allowed to sell shares on the open market. There are quite a few hoops at that, but the most common are spelled out in SEC Rule 144 and Rule 144(k). Actual paper stock certificates are used when “restricted” shares are given to an insider and they actually are stamped “Restricted” in red on the certificate. We even had a CFO of a $Billion technology company pull up to our office, with his new speedboat being hauled behind his new SUV, to hand us a restricted stock certificate he wanted to sell that was worth several $Million. Yeah, those kind of “insiders”.

Rule 144 & Rule 144(k)

When you acquire restricted (unregistered) securities or hold control securities, you must file for an exemption from the SEC’s registration requirements to sell restricted shares – or if they are registered, you must file a public notification of the sale. Rule 144 allows public resale of restricted and control securities if a number of conditions are met. This overview tells you what you need to know about selling your restricted or control securities. It also describes how to have a restrictive legend removed.

Some of the restrictions on the sales include how long that person has held those shares, the number of shares that can be sold in a specific period of time and even how those shares can be sold by the broker.

Restricted and Control Securities

Restricted securities are securities acquired in unregistered, private sales from the issuer or from an affiliate of the issuer. Investors typically receive restricted securities through private placement offerings, Regulation D offerings, employee stock benefit plans, as compensation for professional services, or in exchange for providing “seed money” or start-up capital. Rule 144(a)(3) identifies what sales produce restricted securities.

Control securities can be restricted or unrestricted but are always those held by an affiliate of the issuer. An affiliate is a person, such as a Director, the CEO & CFO, or large shareholder in a relationship of control with the issuer. Control means the power to direct the management and policies of the company in question, whether through the ownership of voting securities, by contract, or otherwise. Most often, that means the top executives.

If you are given restricted securities because you are an insider or were a seed investor, you almost always will receive a certificate stamped with a “restricted” legend. The legend is just a stamp that indicates that the securities may not be resold in the marketplace unless they are registered with the SEC or are exempted from the registration requirements.

There are plenty of technical terms and other pieces of information regarding these types of sales, but that’s not important. As long as you understand the general restrictions, that’s all you need to know more than 90% of investors do.

Should I Sell When The CEO Does?

In a few words… probably not.

There are many, many reasons why an insider like a CEO or a CFO will sell some of his or her shares. Maybe he is looking to purchase a new vacation home (or payoff his new boat like our CFO friend). Or, his son or daughter is heading off to college and he needs some cash for tuition and other expenses. Or, most commonly (in our experience), the stock has made a nice run and the executive is basically looking to diversify.

We’ve seen in many times where a CEO was there at the beginning. Maybe he had plenty of money before, but he’s spent years, if not decades making the business into what it is today. During growth years, before the company became as big as it is now, that CEO may have been paid only pittance in actual cash compared to other CEOs in the same industry for those years. Instead of big paychecks, he was given restricted shares of stock as additional compensation. Doing that saved the company quite a bit of cash and gave that CEO a huge incentive to grow that company and increase the stock price. On paper, he might have $20 million in stock, but only a couple hundred thousand in actual cash or other investments from all of those years of work. If any of us were in that situation, the wise thing would be to sell at least a portion of those shares to diversify, buy an annuity, insurance, whatever. Let’s say that CEO does not sell anything, and does not plan to until well after he retires, only when he needs it. Now, he’s left and still has his $20 million in stock only. The next CEO is a crook and is caught with accounting irregularities. The stock plummets and bankruptcy is coming. The shares are now worthless. He should have sold some, no?

When an insider like a CEO sells shares (whether restricted or not), his broker needs to file a Form 144 with the SEC. The information on that form is what is made public and we all see online through financial websites like Yahoo that list insider sales. Rule 144 limits the number of shares that an insider can sell in a rolling 90 day period. The limit on the number of shares is tied to the average volume of the stock or the number of shares outstanding and varies from company to company and can even vary widely from one 90-day period to the next.

A wise broker will make ONE filing that mentions all of the shares that the CEO plans to sell in the next 90 days or less. That way, services like Yahoo Finance show just that one filing.

Many brokers have no experience with Rule 144 and make a filing each and every day that shares are sold listing just the amount sold. That’s fine as far as disclosure laws go – but now Yahoo Finance might show 25 sales over 25 days where the CEO is selling around 10,000 shares each day for each of those 25 days.

Wouldn’t it be less alarming as an investor if you saw that the CEO had just one filing for 250,000 and that was it? Psychologically, seeing 10,000 share sales over and over and over makes investors more likely to think the CEO is just cashing out and thinks the stock will drop.

So when you see smaller sales over and over and over by an executive, take a look at the history of his or her sales. It may be nothing more than a stupid broker filing each day instead of filing just once for the entire sell order.

If you see a CEO selling and those sales significantly drop the number of shares he holds, that makes even us nervous. That’s a warning sign. We are also concerned when the insider uses an idiot for a broker who files for each and every sale. That insider is either not knowledgeable enough to use someone who knows how to minimize the impact of shareholders seeing all of those filings, or doesn’t care enough to worry about the appearance of all of those sales. Shouldn’t a CEO be better than that? We think so.

– See more at:http://falconstocks.com/information/insideractivity.htm

Nasdaq Turns Positive for 2015

Stocks traded about 1% higher Monday, attempting to further a recent recovery from correction levels, as investors awaited earnings and concerns from Friday’s jobs report on the timing of a rate hike.

The Dow Jones industrial average gained more than 100 points.

The Nasdaq composite came back into positive territory for 2015. The Dow and S&P500 stayed in negative territory for the year so far.

All three major averages gained to come within 10 percent of their 52-week highs, out of correction territory. The small-cap Russell 2000 remained in correction mode, about 12 percent from its 52-week high.