HTML clipboard FRIDAY – The S&P 500 was steady Friday as the benchmark index looked to close out its second consecutive positive week.

Overall, stocks were mixed early.

For the week, the S&P 500 and Nasdaq are up more than 1% and 2%, respectively. The Dow is marginally higher.

The S&P 500 is now up more than 3% in March, more than erasing its losses since Russia invaded Ukraine late last month.

The rebound has come even as the war in Ukraine continues and the Federal Reserve is set to hike interest rates several more times this year – some analysts saying as many as seven increases.

On Monday, Fed Chair Jerome Powell vowed to be tough on inflation. The remarks came after the Federal Reserve raised interest rates for the first time since 2018 last week, with hikes coming at each of the six remaining policy meetings this year.

Powell noted rate hikes could go from quarter-percentage-point moves to more aggressive half-point increases.

The central bank chief’s comments led Wall Street to raise rate hike expectations, with firms from Goldman Sachs to Bank of America penciling in half-point hikes in future Fed meetings this year.

Meanwhile, investors looked to promising signs the economy can run strong even as the Fed tightens monetary policy to address inflation.

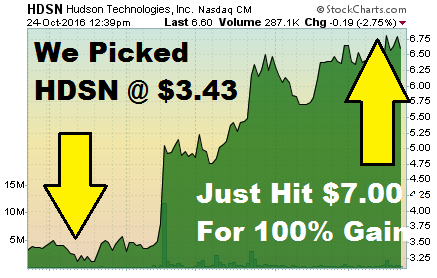

Check out the top-rated Penny Stocks To Buy website that’s unbiased and family run for 18 years!